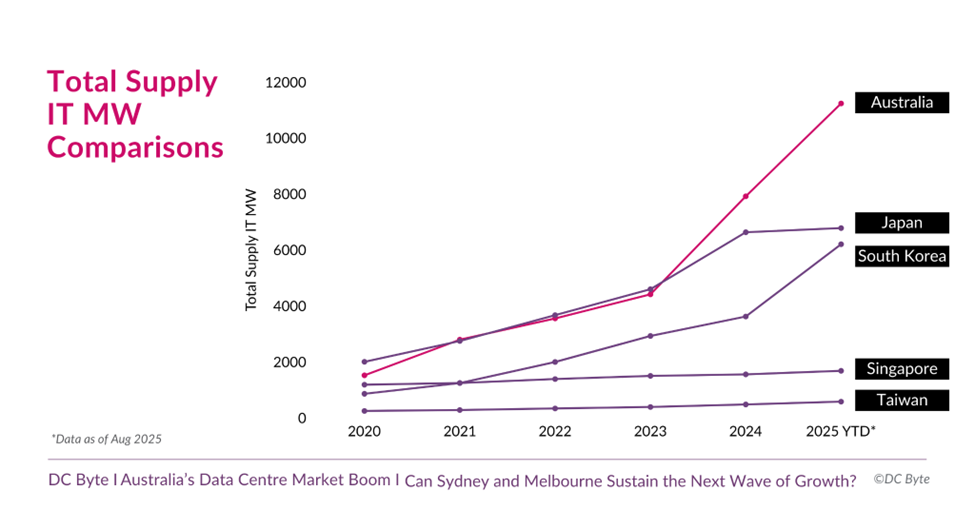

Australia’s data centre sector has accelerated to become the world’s second-largest investment destination, following only the United States. Total supply has increased sevenfold in just five years to more than 11 GW. This pace of expansion signals a decisive shift: Australia has moved from a supporting role in APAC’s digital economy to a central hub drawing sustained global capital.

Hyperscalers are leading this surge, with AWS announcing a US$13 billion investment through 2029 to sustain its Australian footprint and fuel AI-driven innovation. The combination of scale, demand, and multi-year capital programs evidences Australia’s position among the most attractive destinations for digital infrastructure globally.

Core Hubs Driving Growth

Sydney and Melbourne remain the market anchors, accounting for just over 89% of national capacity – with Sydney at 5.3 GW and Melbourne at 4.7 GW. Their dominance reflects a reinforcing cycle: the early concentration of data centres in these cities due to an attractive business and political environment fostered dense connectivity ecosystems and mature infrastructure, which in turn further fueled demand from enterprises and hyperscalers. This sustained demand has further entrenched Sydney and Melbourne as the core hubs of Australia’s data centre market.

Yet reliance on two metros creates structural risks. Power, land, and water are increasingly constrained, and future growth will depend on timely grid upgrades and supportive policy frameworks. For instance, Macquarie Park, located in North Sydney, has begun facing lengthening lead times for power allocation. While Sydney and Melbourne remain the direct path to scale, they also face the highest exposure to bottlenecks.

Leading Operators: Scale and Competition

Australia’s colocation market is highly consolidated, with a small group of predominantly local operators controlling most of the national capacity. These operators scaled early, secured long-term hyperscaler relationships, and entrenched their brands in a rapidly expanding market, creating a considerable challenge for new entrants to gain a foothold. Among the leaders, CDC Data Centres and AirTrunk command a significant share of wholesale colocation supply. NEXTDC is also active in the wholesale segment, while maintaining a strong focus on enterprise customers and interconnection. Equinix leverages its global platform to capture enterprise demand, and DigiCo’s acquisitions of Global Switch Australia and iSeek highlight the role of consolidation in shaping the domestic landscape.

Local incumbents AirTrunk, CDC Data Centres, and NEXTDC have a combined pipeline of 4.6 GW, while newer entrants such as Stack Infrastructure and Goodman add a further 1.7 GW. Established operators benefit from entrenched hyperscaler relationships, while newer players are entering with sizeable pipelines of their own. Despite the competitive market, operators with differentiated strategies such as secondary market entry, sustainability-driven leadership, and AI-optimised capacity can capture meaningful opportunities.

Investment Trajectory and AI’s Role

Australia is entering a capital-intensive decade, with a forecasted US$33 billion in cumulative capex by 2030. This growth is being driven by two overlapping waves of demand, the continued expansion of cloud platforms and the rapid acceleration of AI workloads. The interplay between the two is reshaping requirements for scale, power density, and interconnection, positioning Australia as a critical hub for next-generation digital infrastructure.

AI demand has moved beyond speculation. It is now reshaping capital flows, driving hyperscalers to prioritise sites that can deliver significant power, rapid timelines, and optionality for future repurposing into cloud or inference capacity. AWS’s multi-year program is emblematic, but other hyperscalers are also aligning roadmaps around Australia due to the relative ease of development of large, quick, and scalable builds. This positions the country not just as a regional hub, but as a strategic market where global players are embedding their AI strategies.

Opportunities and Risks

Australia’s data centre market shows no signs of slowing, but the investment story comes with nuance. Rapid expansion, large-scale capital commitments, and a concentration of supply in a handful of core hubs present both advantages and challenges. The landscape is defined by clear opportunities, underpinned by structural demand, but also notable risks that could affect returns.

Opportunities

- Established infrastructure – multiple submarine cable landings, established cloud regions, and carrier-neutral interconnections. Power infrastructure upgrades in New South Wales and Victoria and general availability of industrial-zoned land further strengthen scalability.

- Hyperscaler commitments – Multi-billion-dollar programs from AWS, Microsoft, and Google anchor demand and reduce revenue volatility, setting the stage for ecosystem growth. Demand for cloud and AI workloads have increased from 48% of total demand to 76% over the past five years.

- Regulatory support – Federal and state governments are increasingly prioritising digital economy enablement, with supportive policy environments beginning to materialise such as New South Wales launching a new authority to fast-track the approval of critical projects.

Risks

- Concentration of capacity – Heavy clustering in Sydney and Melbourne raises exposure to power, land, and water constraints.

- Development costs – Rising development costs are pushing build prices higher and extending delivery schedules. Based on Turner and Townsend data, build costs in Sydney and Melbourne climbed from an average of US$9.3 million/MW in 2023 to an average of US$10 million/MW in 2024.

- Sustainability pressures – Grid resilience and renewable procurement are under pressure, while AI-dense workloads add to cooling and ESG compliance risks.

Looking Ahead

Australia has cemented its role as a cornerstone of APAC’s digital infrastructure, competing at a scale comparable to the world’s leading hubs. The critical test for the next five years will be whether Sydney and Melbourne can sustain further growth while new corridors are unlocked.

Power availability, sustainability, and diversification will be decisive in determining if Australia can balance scale with resilience. At stake is not just continued growth, but whether investment in grid infrastructure and established regulatory processes can keep pace with demand.

What is clear is that Australia has moved firmly into the global top tier of digital infrastructure markets, with entrenched demand and AI-driven acceleration ensuring that capital commitments will remain strong through the decade. Yet the market’s heavy reliance on Sydney and Melbourne leaves critical questions unanswered.

Can Australia diversify fast enough to meet demand, or will bottlenecks in land and power become the limiting factor? For investors and operators alike, the answers will shape not just Australia’s trajectory, but its role in the global digital economy.

Tech Capital