Phosphate was supposed to be the outback’s next big economic opportunity, but one mining company says the cost of rail freight has brought its project to the end of the line.

Just three years after its first shipments were celebrated for reducing Australia’s reliance on imports, the Ardmore Mine, about 140 kilometres south of Mount Isa, has entered voluntary administration, with about 150 jobs now on the line.

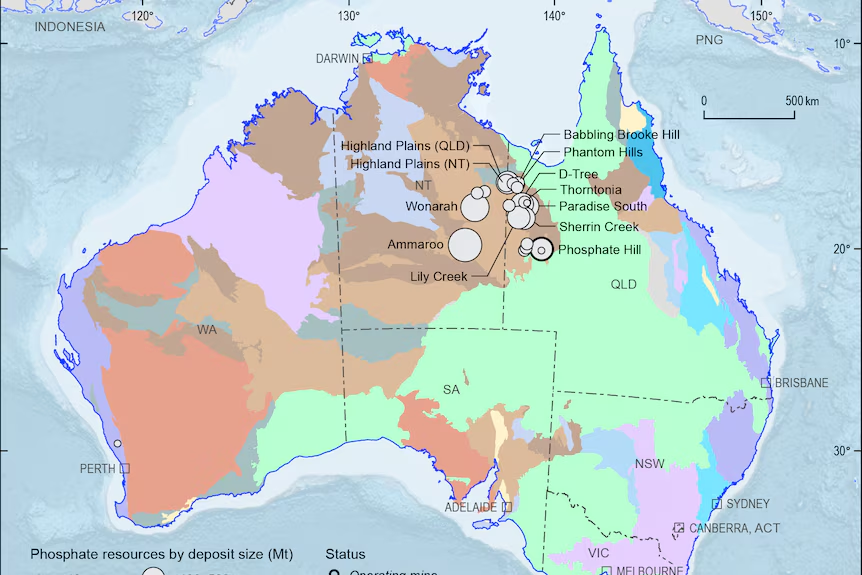

The critical mineral is a key ingredient in fertiliser and some rechargeable batteries, and the Cambrian Georgina Basin, on the Queensland-Northern Territory border, contains some of the largest untapped deposits in the world.

But as the Centrex owned-and-operated site joins a growing list of the region’s minerals projects in financial strife, a common issue has emerged.

The cost of accessing the rail network, operated by government-owned Queensland Rail (QR), is being blamed for stopping prosperity in its tracks.

Untapped potential

As the international shortage of fertiliser supply hit farmers hard in 2022, mining companies described the Georgina basin as a “honey pot waiting to be tapped”.

They claimed domestic phosphate production had the potential to bring food security to Australia, and open the outback to new industries such as cropping and renewable energy components.

By September 2024, Centrex sent its first shipment of high-grade phosphate to India, via the Townsville Port.

“The Georgina Basin … it’s a huge area; it’s got some really good phosphate deposits,” Centrex’s managing director Robert Mencel said at the time.

But now Centrex is citing freight costs along the Mount Isa to Townsville line as the main factor in its financial woes.

Cloncurry Shire Mayor Greg Campbell said most of the 150 workers who could lose their jobs were local residents.

“There’s 150 plus years of mining working well in our shire … so it’s very disappointing,” Cr Campbell said.

“[It also takes] the shine off how much positivity is still in our shire and in the region.”

Off the rails

The Centrex project used Australia’s largest rail freight operator, Aurizon, to transport its phosphate 950km east to the Townsville Port.

Aurizon accesses the Queensland Rail-owned network through an undertaking given to the Queensland Competition Authority, which regulates the prices for monopoly infrastructure in the state.

The authority is investigating the 2025 undertaking, which from June will set out the terms and conditions for third parties to access more than 6,500km of track.

A spokesperson for Aurizon, which has faced criticism over the cost of access to its own network, said the company shared Centrex’s concerns.

“Aurizon has previously made a joint submission with Centrex and other companies indicating our concern with the high cost of using the Mount Isa to Townsville rail track,” the spokesperson said.

In that submission, Aurizon said its internal benchmarking showed the rail corridor was the most expensive of its type in the country, charging two to three times other similar tracks.

“[They] need to provide a substantial reduction in rail access charges that will incentivise more bulk freight to be carried on rail along this corridor rather than on publicly funded roads,” the spokesperson said.

Mining giant Glencore also made a submission, which said the cost of the Mount Isa line contributed to the decision to close its copper mining operations in the region.

“The closure decision of the copper mines was made on the grounds of economic viability,” the submission said.

“The economic viability of copper mining was definitely affected by the high cost of the rail access and transportation.

“Glencore has made submissions of concern across all of Queensland Rail’s access undertakings since the separation of the Aurizon Network and Queensland Rail undertakings.”

Canary in the phosphate mine

Queensland Rail’s head of regional Scott Cornish said revenue received from the access charges was used to cover the capital and operational costs of running the railway.

“Network access service is one component in a complex logistics supply chain,” he said.

“[It] also includes above rail operations, road pick-up and delivery services, intermodal terminal services and ship loading at the Port of Townsville.”

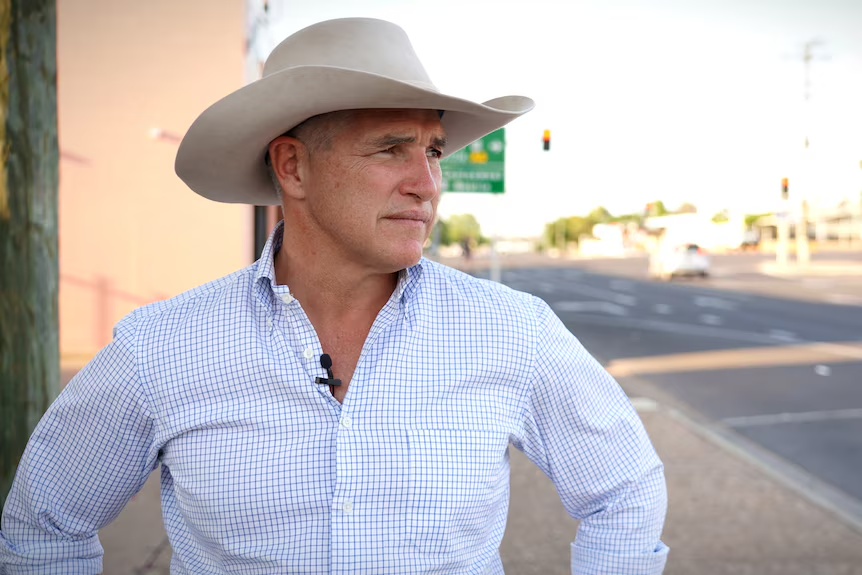

Robbie Katter, the state member for Traeger and leader of the Katter Australia Party, said the collapse of Centrex highlighted a systemic issue.

“It’s not the biggest mine in the region … but at the same time, it’s that canary in the coal mine,” Mr Katter said.

He said freight that should be on rail was being pushed onto the Flinders Highway, which in turn required more maintenance.

“Taxpayers aren’t going to miss the measly bit of profit they get off the rail line,”

Mr Katter said.

“But they’re definitely going to miss all the economic benefit they get off Centrex and other mines closing, or other ones not opening, because this rail line is not performing.”

At a different site 200km north of Mount Isa, North West Phosphate operates a mine at one of Australia’s largest phosphate deposits.

Managing director John Cotter is still optimistic about the mineral’s future in North West Queensland, but he said something had to give.

“We’ve chosen the logistics path that was different to Centrex to get around [rail transport costs], but it still doesn’t remove the base problem,” he said.

“We have the most expensive rail line and power system in the country, in the heart of the area that’s meant to be developing the wealth of their nation.”

ABC News

Why are the costs so high they should be cheaper than trucking the product. This creates a disincentive to use rail.

Would have been better to have left QR in Public Hands we all know privatisation of rail in Australia has lead to freight moving off rail onto road and overall costs for governments increasing as roads are shredded.