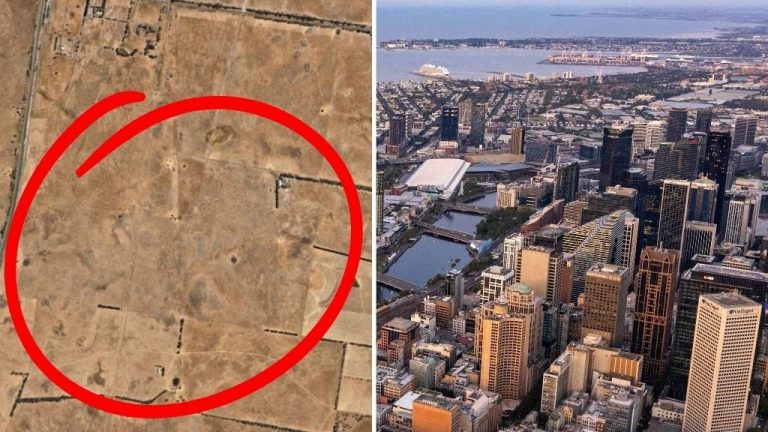

A massive 507 ha site in Beveridge, equivalent in size to Footscray or Brunswick, is set for a $4.5bn transformation into a global logistics and data centre powerhouse.

The landholding, about 40km north of Melbourne’s CBD, sits within the state’s planned Northern Freight Precinct and borders the future Beveridge Intermodal Freight Terminal, a key Victorian link to the Inland Rail project connecting Melbourne and Brisbane.

Global asset manager C Capital has appointed Lendlease as Master Development Partner to transform the massive greenfield site into a hi-tech industrial precinct for the Merriang Rd site.

Once fully developed, the precinct is expected to have an end value of up to $4.5bn, spanning logistics warehouses, industrial facilities and data centre assets, sectors experiencing sustained demand amid low vacancy rates across Victoria.

The Merriang Rd landholding sits on the southern boundary of the planned Beveridge Intermodal Freight Terminal, positioning it as a future logistics gateway for Melbourne’s north.

Under the agreement, Lendlease will advise C Capital through the rezoning and infrastructure enablement phase, with the option to acquire all or part of the land once approvals are in place.

Lendlease may also introduce additional investment partners to progress later stages of development.

The Victorian Government has flagged Beveridge as a key freight and industrial growth zone, with the Northern Freight Precinct and Inland Rail connection set to reshape logistics movement across Melbourne’s north.

Lendlease CEO of Development Tom Mackellar said the partnership reflected strong demand for new industrial and logistics supply in Victoria.

“The ongoing demand for industrial and logistics sites in Victoria, and forecast low vacancy rates, underscores the need for new supply of strategically located industrial and logistics assets,” Mr Mackellar said.

“Our development partnership with C Capital provides optionality to grow our development pipeline with logistics, industrial and data centre assets.”

For C Capital, the Merriang Rd acquisition represents a major step in expanding its Australian real assets strategy following its acquisition of Richmond Funds Management last year.

C Capital partner and co-head of Australia Seil Kim said the scale and location of the site made it a rare institutional opportunity.

“This investment is a key step in growing C Capital’s Australian platform and underscores our commitment to long-term capital deployment in markets with strong fundamentals,” Mr Kim said.

The project is expected to play a major role in the evolution of Victoria’s freight and industrial ecosystem, with Inland Rail positioning Beveridge as a critical logistics link between Melbourne and the eastern states.