The 10-year outlook for submarine fibre cable capacity demand between Southeast Asia and the United States is overwhelmingly positive, predicting substantial, continued growth in capacity requirements well into the 2030s.

While specific capacity figures for the entire route for the full decade are not consistently forecasted, the general market trends and announced cable projects indicate an aggressive expansion driven by several key factors.

Key Demand Drivers (2025 – 2035):

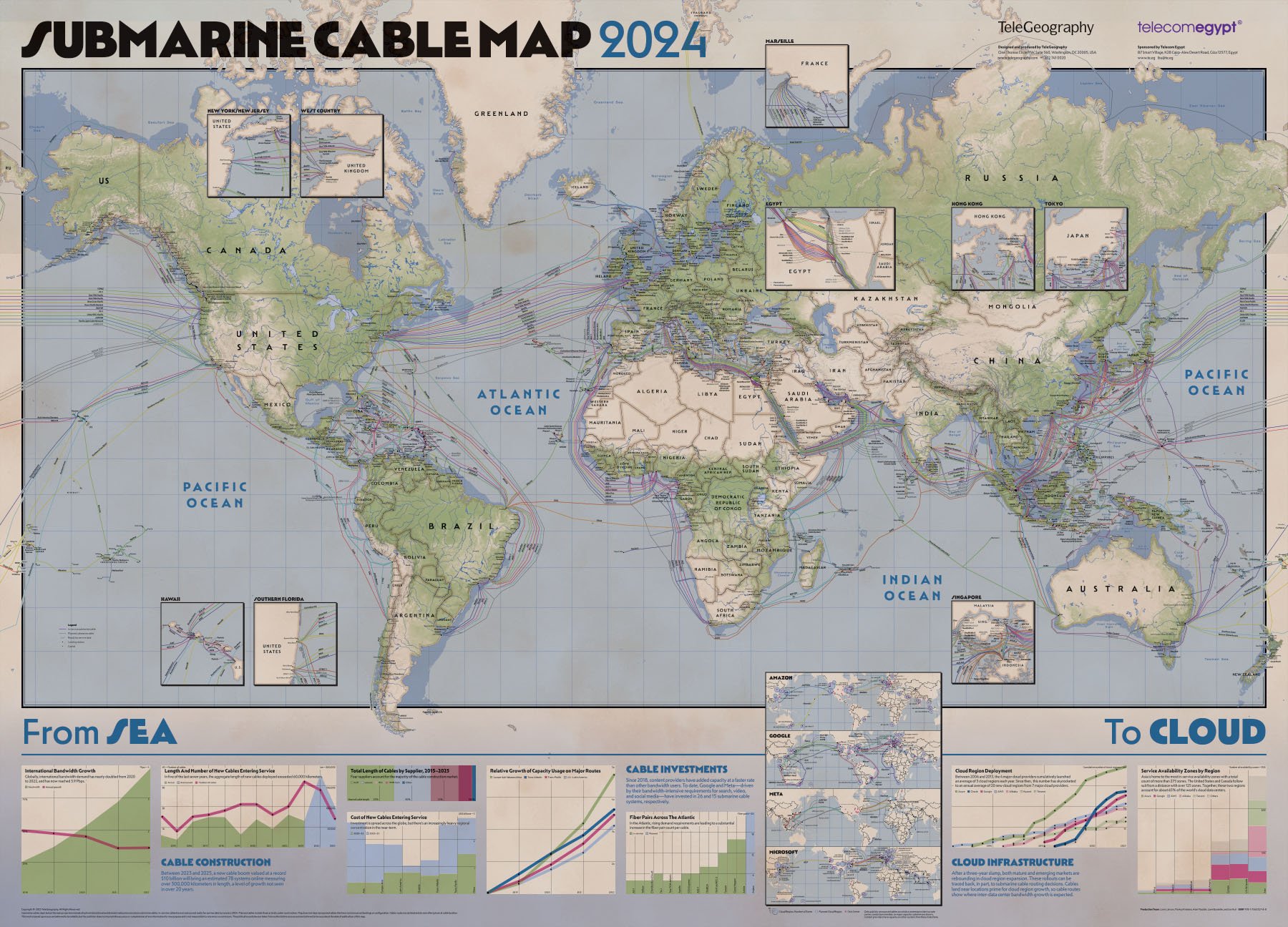

- Hyperscale Cloud and OTT Providers: Major tech companies (e.g., Google, Meta, Amazon) are the primary drivers, consistently investing in new, private, ultra-high-capacity cables (e.g., Bifrost, Echo, Apricot, Candle systems) to connect their global data centers in North America with the rapidly growing data markets in Asia Pacific, particularly Singapore and Indonesia.

- Surging Data Traffic in Asia Pacific (APAC): Southeast Asia is the world’s fastest-growing digital market.

- Exponential growth in internet penetration, smartphone use, and data consumption.

- The digital economy across ASEAN is experiencing explosive growth, fueling the need for international connectivity.

- Emerging Technologies: The widespread adoption of bandwidth-intensive applications is accelerating demand:

- Cloud Computing and Data Center Interconnect (DCI).

- Artificial Intelligence (AI), which requires massive, high-speed data transfer between training and inference locations.

- 5G rollout and Internet of Things (IoT) expansion.

- Technological Advancement: New cable designs are significantly increasing capacity:

- Space Division Multiplexing (SDM) and multi-core fibre are being deployed to increase the number of fiber pairs and overall throughput, with new systems designed to carry hundreds of terabits per second (Tbps).

- 400 GbE/800 GbE carrier upgrade cycles.

- Geopolitical and Resilience Needs: The need for geographic route diversity and resilience is a major factor. New cables are being designed to avoid geopolitical flashpoints (like the South China Sea) and increase redundancy, often connecting through alternative landing points and diverse Pacific routes.

Market Indicators and Projected Growth:

- Capacity Explosion: Multiple new trans-Pacific and intra-Asia cables with capacities exceeding 100 Tbps are planned to come online between 2024 and 2028, significantly boosting the region’s total capacity.

- Global Market Growth: The overall submarine optical fibre cable market is forecasted to grow at a high Compound Annual Growth Rate (CAGR) globally and particularly in the Asia Pacific region, with projections generally ranging from 11% to over 12% CAGR from 2025 to 2030. Asia Pacific is often projected as the region with the fastest growth.

In summary, the next 10 years will see demand for submarine cable capacity between Southeast Asia and the US soar, driven by the digital transformation of Asia, massive investments by tech giants, and the deployment of new, high-capacity, and strategically diversified cable systems.